Home interest 2024 Bank

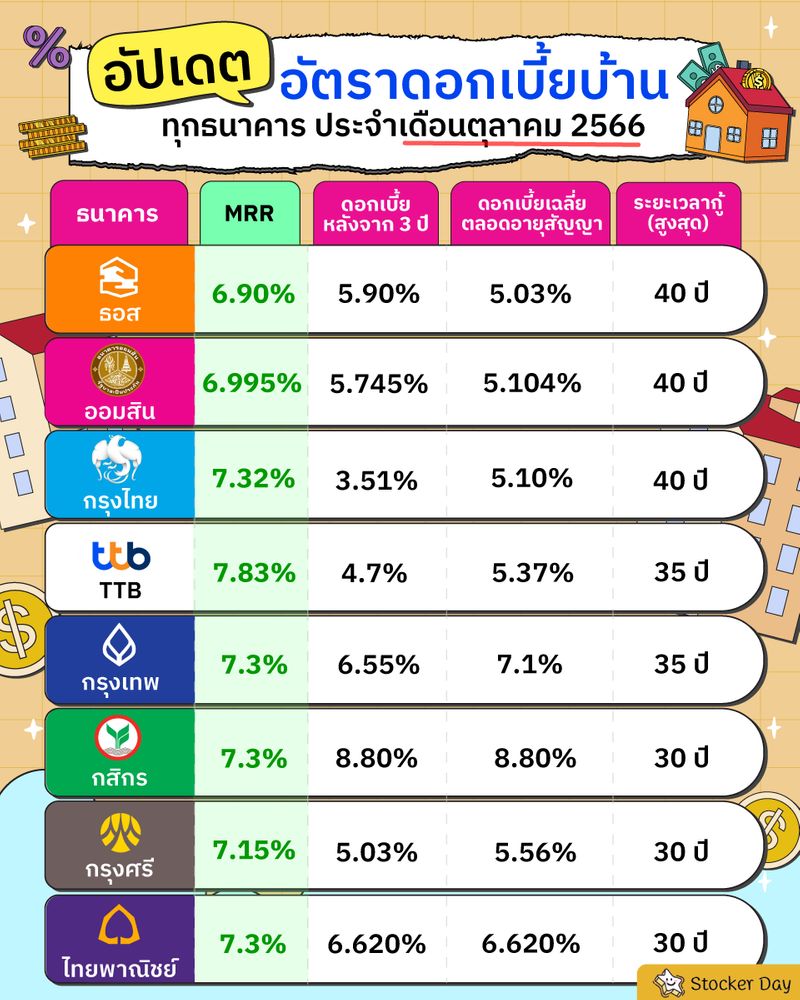

Home interest 2024 Bank Summary Government Housing Bank (Or Sor.) There is a plan to adjust the new home interest rate in 2024. There are main factors from the market interest rate trend that has increased in the past. Those interested in buying a house Or those who are burden to pay the house need […]

Home interest 2024 Bank

Summary

Government Housing Bank

(Or Sor.) There is a plan to adjust the new home interest rate in 2024.

There are main factors from the market interest rate trend that has increased in the past.

Those interested in buying a house

Or those who are burden to pay the house need to prepare to deal with the increased expenditures.

Introduction

Home interest rates are an important factor that affects the decision to buy home and financial planning of consumers.

With a large lump debt like home loans

The borrower needs to be fully understood about interest rates and factors that affect the adjustment of home interest rates.

To prepare to deal with changes that may affect financial liquidity

The main factor that affects home interest rates

1.

Market interest rate trend

- The world interest rate trend has an effect on the cost of fundraising that commercial banks use in loans

- When the market interest rate increases

Commercial banks have to adjust the interest rates released to

.

.

2. Economic conditions

- Economic conditions affect the demand for home loans and credit risks of the borrower

- During the growth of the economyThe demand for home loans is usually increased.

Which may result in higher interest rates to control the risk.

3. State monetary policy

- Government monetary policyEspecially the Monetary Policy Committee

(MPC) has a huge effect on the interest rate in the economy - If the MPC

Adjust the policy interest rate

Commercial banks will adjust the interest rates released to

4. Market competition

- Competition in the home loan market affects the bank’s interest rate strategy

- during high competition

The bank may set a lower interest rate to attract new customers

5. Bank’s operating costs

- Bank’s operating costs are one factor that affects home interest rates

- The bank has operational costs such as administrative expenses.

Employee salary paymentAnd other expenses

Which the bank may set higher interest rates to cover these costs.

Consider for the case of higher interest rates

1. Debt burden management

- Those who are burden to pay the house should plan and manage the debt carefully.

- Consider increasing revenue or reducing unnecessary expenses to expand the ability to pay off debt

2. Home loans

- If the house’s interest rate has increased dramatically

May consider home loans to reduce monthly burdens - Refinancing allows you to switch to home loans with lower interest rates and reduce debt burden.

3. Request for debt

- If the borrower encounters financial problems and cannot pay home loans

May consider the request to pay the debt with the bank - The bank may approve the debt for a period of time.

So that the person can adjust the financial condition and return to pay the debt

Summary

Consumers should closely follow the trend of home interest rates and plan to deal with the change carefully.

Understanding factors that affect home interest and higher preparation will help reduce the effects on financial liquidity and maintain the financial stability of the borrower.

Keyword Phrase Tags

- House interest 2024

- Interest adjustment

- Market interest rate

- Higher home interest strategy

- Home loans